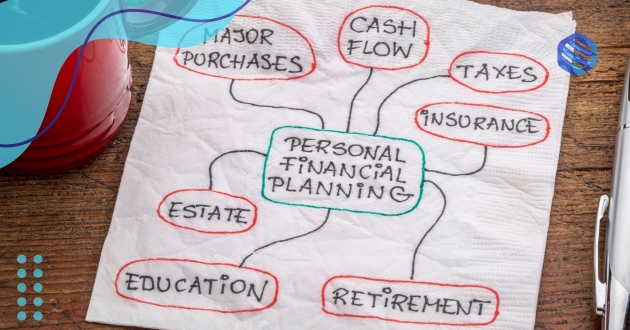

Financial planning education requirements are crucial for anyone aspiring to build a career in personal finance. At the very beginning of one’s journey into the financial planning profession, understanding the educational prerequisites is essential.

In today’s competitive financial landscape, meeting the financial planning education requirements is not just about fulfilling academic criteria; it’s about acquiring the knowledge and skills to thrive in a dynamic market.

Furthermore, the financial planning education requirements also emphasize ethical considerations, communication skills, and analytical thinking. These competencies are essential for building trust with clients and ensuring that their financial goals are met responsibly.

Key Certifications for Financial Planners

1. Certified Financial Planner (CFP) Designation

One of the most recognized credentials in the financial planning industry is the Certified Financial Planner (CFP) designation.

This certification requires candidates to complete rigorous coursework, pass a comprehensive exam, and meet experience requirements. The CFP designation demonstrates that a financial planner is competent in providing professional services.

2. Chartered Financial Consultant (ChFC) Certification

Another important credential is the Chartered Financial Consultant (ChFC) certification.

While similar to the CFP, the ChFC program offers additional flexibility in elective courses, allowing professionals to specialize in areas such as retirement planning or wealth management.

Educational Pathways to Become a Financial Planner

1. Bachelor’s Degree in Finance or a Related Field

Most financial planners begin their careers by obtaining a bachelor’s degree in finance, economics, accounting, or business administration.

These degrees provide foundational knowledge in financial markets, investment strategies, and personal finance management. Additionally, they lay the groundwork for more specialized education later on.

2. Postgraduate Degrees and Specialized Programs (Financial planning education requirements)

To further enhance their expertise, many professionals pursue postgraduate degrees or certificates. Master’s degrees in finance or financial planning programs offer advanced coursework and the opportunity to focus on niche areas like tax planning or estate management.

Specialized programs, such as those offered by financial planning associations, also provide targeted education that aligns with industry standards.

Online Learning Platforms for Financial Planning Education

In today’s digital age, meeting the financial planning education requirements has become more accessible thanks to the rise of online learning platforms. These platforms offer a wide range of courses that allow aspiring financial planners to gain the knowledge they need at their own pace.

Whether you’re looking to get certified or simply enhance your financial expertise, online resources provide flexible learning options that fit into busy schedules.

One of the most popular platforms for acquiring financial planning skills is Udemy. With a vast selection of courses on personal finance, investment strategies, and retirement planning, Udemy offers affordable and comprehensive options that align with industry requirements.

This accessibility enables more individuals to fulfill educational prerequisites and advance their careers in financial planning.

Continuing Education and Staying Updated

1. Importance of Ongoing Education

Financial planning is a constantly evolving field. Professionals must stay updated on new laws, regulations, and trends to provide the best advice to their clients.

Continuing education ensures that planners remain informed about the latest developments and continue to meet industry standards.

2. Professional Development and Networking (Financial planning education requirements)

Attending seminars, workshops, and conferences is another way for financial planners to enhance their knowledge.

These events provide opportunities for networking, learning from industry leaders, and gaining insights into emerging financial trends.

The Importance of Financial Education for Retirees

As individuals approach retirement, the need for specialized financial guidance becomes critical. While financial planning education requirements primarily focus on equipping professionals with the knowledge to manage various financial situations, they also emphasize the importance of understanding the unique needs of retirees.

A well-educated financial planner is better equipped to address retirement planning concerns, including managing retirement accounts, investments, and ensuring a steady income throughout retirement.

For retirees, having access to financial education for retirees can make all the difference in achieving long-term financial security. Financial planners, with their rigorous training, play a key role in helping retirees make informed decisions about their financial futures, from budgeting to estate planning.

The Role of Ethics in Financial Planning Education

1. Why Ethics Matter in Financial Planning

One key aspect often included in financial planning education requirements is the study of ethics. Financial planners are entrusted with managing their clients’ financial futures, which requires a high level of trust and responsibility.

Ethical education ensures that professionals uphold integrity, transparency, and fairness when advising clients. This not only protects the client but also enhances the reputation and credibility of the financial planning profession.

2. Courses and Certifications Focused on Ethics

Many financial planning programs incorporate ethics courses, ensuring that future planners understand the moral and legal obligations of their role.

Certifications such as the Certified Financial Planner (CFP) mandate that individuals complete an ethics component before certification, reinforcing the importance of ethical decision-making in the field.

The Impact of Technology on Financial Planning Education

1. Integrating Technology into Financial Planning

The financial industry is constantly evolving, and technology plays a significant role in modern financial planning. As part of the financial planning education requirements, students are now expected to gain proficiency in various financial software and tools.

These digital platforms assist planners in creating accurate financial models, managing investments, and providing real-time financial advice to clients.

2. Learning Financial Software (Financial planning education requirements)

Mastering financial planning software, such as budgeting tools and retirement calculators, is essential for aspiring financial planners.

Programs that meet industry standards include hands-on training in these tools, preparing students to adapt to the tech-driven changes in financial services. This technological knowledge sets financial planners apart in an increasingly competitive market.

The Importance of Soft Skills in Financial Planning Education

1. Communication Skills for Financial Planners

While technical expertise is crucial, soft skills are equally important when working in financial planning. As part of the financial planning education requirements, many programs emphasize the development of communication skills.

Financial planners need to explain complex financial concepts to clients in a way that is easy to understand, making effective communication key to client relationships and trust.

2. Emotional Intelligence and Client Relations

In addition to communication, emotional intelligence is vital for a successful career in financial planning. Understanding client emotions, especially in relation to financial decisions, allows planners to offer personalized advice.

Education programs increasingly include training on emotional intelligence, helping future financial planners manage client relationships effectively.

Conclusion: Financial planning education requirements

Meeting the financial planning education requirements is a fundamental step for anyone aspiring to succeed in the financial planning profession. From obtaining a solid academic foundation to gaining essential certifications, these requirements ensure that financial planners are well-equipped to guide clients through their financial journeys.

Beyond the technical knowledge, financial planning education emphasizes the development of key skills, such as ethical decision-making, communication, and emotional intelligence.

Ultimately, fulfilling the financial planning education requirements sets the stage for long-term career success. It ensures that financial planners are not only qualified but also adaptable to industry changes and client needs.