Tips for saving money monthly can help you create a more sustainable financial plan, ensuring you are prepared for future expenses.

Moreover, the process of saving doesn’t have to be overwhelming. With the right mindset and practical advice, you can start saving money without feeling deprived of the things you enjoy.

Finally, understanding how to prioritize your expenses and reduce unnecessary costs is a key component of financial success. By following tips for saving money monthly, you’ll be able to allocate your income more effectively, reduce stress, and achieve your long-term financial goals.

1. Track Your Spending Regularly

One of the most effective ways to save money is by tracking your spending. When you monitor where your money goes, it’s easier to identify areas where you can cut back.

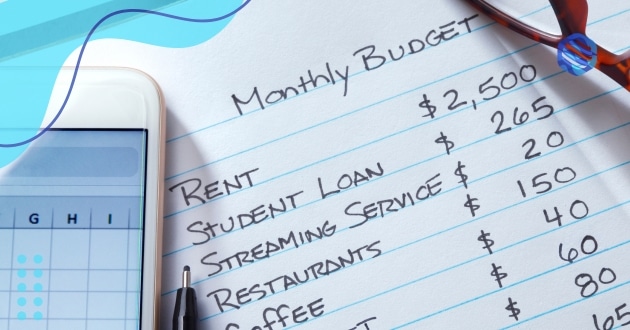

Start by categorizing your expenses into fixed (like rent or mortgage) and variable (like dining out or entertainment). This allows you to see which areas can be adjusted to save more money.

There are many budgeting tools and apps that can help you stay on top of your finances. Tools like these allow you to track your daily expenses and offer insights into your spending habits.

By using these tools, you’ll be more aware of where your money is going, making it easier to stay on budget and avoid unnecessary purchases.

2. Automate Your Savings

Another effective strategy is to automate your savings.

By setting up automatic transfers from your checking account to a savings account each month, you can ensure that you’re consistently putting money aside.

This method helps you save without even thinking about it, as the money is moved before you can spend it.

Having clear savings goals can also motivate you to save more each month.

Whether you’re saving for a vacation, a new car, or an emergency fund, having a specific goal in mind will keep you focused.

Break your goal down into smaller, more manageable amounts to make the process easier and more achievable.

3. Cut Unnecessary Expenses

Reducing unnecessary expenses is another crucial tip for saving money. Look at your monthly subscriptions, dining habits, and other non-essential costs.

Are there services or memberships you rarely use? Eliminating these can free up extra money each month that can go directly into your savings.

Another way to save is by negotiating your bills. From internet services to insurance premiums, many providers are open to lowering rates if you ask.

You may be surprised how much you can save simply by asking for a better deal.

Incorporating these tips for saving money monthly can significantly improve your financial situation over time.

By making small adjustments, tracking your spending, and automating savings, you’ll be on your way to achieving your financial goals.

4. Review and Adjust Your Budget Regularly

One essential tip for saving money monthly is to continually review and adjust your budget.

While many people create a budget, it’s important to revisit it regularly to ensure it aligns with your financial goals and current expenses.

As your financial situation changes, your priorities may shift. A budget created a year ago may no longer reflect your current needs or lifestyle.

By regularly evaluating your priorities, you can make necessary adjustments and ensure your spending is directed toward what matters most.

5. Make Use of Cashback and Rewards Programs (Tips for saving money monthly)

Another effective way to save money each month is by using cashback and rewards programs.

Many credit cards and apps offer cashback on purchases, which can add up to significant savings over time.

Not all rewards programs are created equal. It’s important to choose ones that match your spending habits.

For instance, if you frequently shop for groceries, opt for a card or program that offers high cashback rates at supermarkets.

6. Take Advantage of Sales and Discounts

Shopping smart is a great way to reduce expenses each month. By planning your purchases around sales and taking advantage of discounts, you can save a considerable amount of money.

Instead of making impulsive buys, plan your larger purchases in advance. Wait for seasonal sales, discounts, or special promotions, especially on items like electronics, clothing, or home appliances.

This strategy allows you to avoid paying full price.

Educate Yourself on Financial Management

A key component of saving money monthly is having a solid understanding of how to manage your overall finances.

When you are aware of where your money is going and how to control it, you can make better decisions that positively impact your savings.

Learning how to manage personal finances can help you create a balanced budget, minimize debt, and maximize your savings over time.

This knowledge empowers you to stay disciplined and reach your financial goals with ease.

Use Financial Tools to Track Your Spending (Tips for saving money monthly)

To effectively save money each month, it’s essential to have a clear picture of your spending habits.

Using financial tools like budgeting apps can help you monitor your income and expenses more efficiently. For instance, Mint is a popular tool that allows you to track your spending, categorize your expenses, and set saving goals.

With real-time updates and detailed insights, it becomes easier to identify areas where you can cut back and save more.

FAQ: Tips for Saving Money Monthly

1. What is the easiest way to start saving money monthly?

The easiest way to start saving money monthly is by creating a budget. Begin by tracking your income and expenses to understand where your money is going. From there, set aside a fixed amount for savings each month, even if it’s small. Automating your savings can also make the process effortless.

2. How much should I save each month?

A general rule of thumb is to save at least 20% of your income each month, but this may vary depending on your financial goals and expenses. Start with what you can afford and increase the amount gradually over time as you get more comfortable with saving.

3. How can I reduce unnecessary expenses to save more?

To reduce unnecessary expenses, review your spending habits regularly. Cut out or limit discretionary spending like dining out, subscription services you no longer use, or impulse shopping. Focus on prioritizing essential expenses and allocate more towards savings.

Conclusion: Tips for saving money monthly

Incorporating effective tips for saving money monthly can significantly improve your financial stability. By taking small, consistent actions like tracking your spending, automating savings, and cutting unnecessary expenses, you can gradually build a solid financial foundation. These simple strategies make saving easier and more manageable over time.

Additionally, regularly reviewing and adjusting your budget ensures that your financial plan remains aligned with your goals. Using tools like budgeting apps can provide valuable insights into your spending habits and help you stay on track. Educating yourself on personal finance is key to making informed decisions.

Ultimately, the journey to saving money is a long-term commitment, but with the right mindset and practical steps, you can achieve your financial objectives. The more proactive you are in managing your money, the greater your chances of building a secure financial future.